En İyi Kampanyayı Tasarlamak için Yarıştılar

İzmir Ekonomi Üniversitesi (İEÜ) İşletme Fakültesi, bu yıl ilk kez düzenlediği dijital pazarlama konulu ‘Brand Craft’ adlı etkinlikte, 18 liseden ...

Hollanda Fırsatını Kaçırmadılar

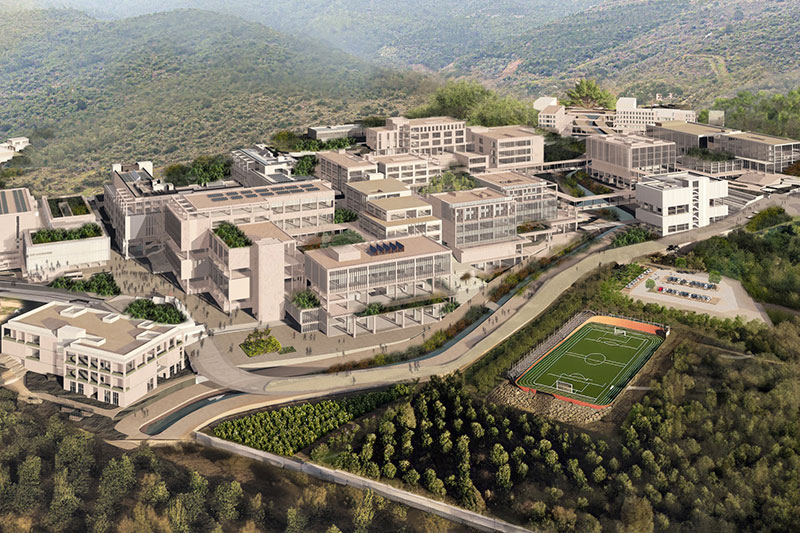

Öğrencilerine yeni kariyer fırsatları yaratmak amacıyla dünyadaki sayılı üniversitelerin yer aldığı IBSEN yaz okulu programına üye olan İzmir Ekonomi Üniversitesi ...

İngiltere'nin 'Elif' yarışı

İzmir Ekonomi Üniversitesi (İEÜ) İşletme Fakültesi Ekonomi Bölümü’nü bu yıl ikincilikle bitiren Elif Larende (22), yüksek not ortalaması ve araştırmalarıyla ...

‘Dijital garson’ Türkiye üçüncüsü

İzmir Ekonomi Üniversitesi (İEÜ) öğrencisi Mehmet Güler, ‘fastposs’ adlı çalışmasıyla Türk Ekonomi Bankası’nın düzenlediği ‘Akıl Fikir Yarışması’nda üçüncü oldu. ...

Ekonomi Bölümü öğrencisi Mahsum Ferat Kaya'dan büyük başarı!

İzmir Ekonomi Üniversitesi (İEÜ) öğrencisi Mahsum Ferat Kaya (22), Alman Akademik Değişim Servisi’nin (DAAD) Türkiye’deki sayılı gence verdiği ‘yaz okulu bursunu’ alarak ...

‘Ahududu’ Türkiye ikincisi

İzmir Ekonomi Üniversitesi (İEÜ) Ekonomi Bölümü öğrencisi Mehmet Güler, yeni nesil sera yöntemleri kullanılarak tarımsal verimliliğin ve enerji tasarrufunun artırılmasına ...